Navigating the complexities of paying taxes yourself can be challenging, especially for OnlyFans creators. As an OnlyFans content creator, you are considered both self-employed individuals under-employed and considered self-employment income, which brings unique tax responsibilities. Understanding these obligations and how to maximize your tax write-offs can significantly impact your net income. This guide aims to provide a thorough overview of tax write-offs for OnlyFans creators, helping you make informed decisions to pay taxes and keep more of your hard-earned money.

Understanding Taxable Income for OnlyFans Creators

When you work as an OnlyFans creator, your net earnings are often categorized as self-employed individuals’ re-employment income. This classification of pay as self-employed and employment as income affects how you report your income and pay taxes.

OnlyFans Expenses You Can Write Off

OnlyFans creators can write off specific expenses to lower their tax rates. The cost should be “ordinary”. It is needed for your business. They must also know about the work you do at JustFans. Examples are: Depending on the platform your specialization in one specific niche is also deductible. It offers you a unique chance to reduce taxable earnings.

What is Taxable Income?

Taxable income is the portion of your adjusted gross income that is subject to taxes. For OnlyFans creators, this includes all earnings from subscriptions, tips, and any other revenue generated through the platform. It’s essential to track all sources of income to ensure accurate reporting.

List of Taxable Income Sources

As an OnlyFans creator, it’s essential to understand the various sources of income that contribute to your taxable income. Properly categorizing and tracking these income sources ensures accurate reporting and compliance with tax regulations. Here’s a detailed look at the different types of income you might receive:

Subscription Fees

Subscription fees are the primary source of income for many OnlyFans creators. These fees are paid by subscribers who access your exclusive content every month. The amount charged can vary widely depending on the content you provide and your pricing strategy. It’s crucial to record these fees meticulously, as they form a significant part of your gross income.

Tips and Donations

Tips and donations are additional earnings that fans may give you to show their appreciation. These payments can be one-time or recurring and are often given for special requests, personalized content, or simply to support your work. Subscription fees, tips, and donations must be reported as part of your total income.

Paid Private Messages

Offering paid private messages is another way to generate income on OnlyFans. Fans may pay for direct interactions, personalized messages, or exclusive content sent through private messaging. This income is particularly valuable for building a closer relationship with your audience while monetizing your time and effort.

Sale of Merchandise or Digital Products

Many creators diversify their income by selling merchandise or digital products. Physical items such as branded clothing, accessories, or other memorabilia can be sold to fans. Additionally, digital products like e-books, exclusive videos, or photo sets provide another revenue stream. All sales of merchandise and digital products are considered taxable income.

Affiliate Marketing Earnings

Affiliate marketing involves promoting products or services from other companies and earning a commission on any sales made through your referral links. As an OnlyFans creator, you might partner with brands that align with your content and recommend their products to your followers. Earnings from affiliate marketing should be tracked carefully and included in your taxable income.

Taxable Income Sources:

- Subscription Fees: Monthly charges paid by subscribers for access to exclusive content.

- Tips and Donations: Additional payments made by fans to show support or for special requests.

- Paid Private Messages: Income from personalized interactions and exclusive content via direct messaging.

- Sale of Merchandise or Digital Products: Revenue from selling physical goods or digital items such as e-books, videos, or photo sets.

- Affiliate Marketing Earnings: Commissions earned by promoting and selling other companies’ products through referral links.

Each of these income sources plays a crucial role in the overall revenue of an OnlyFans creator. Proper documentation and understanding of these streams of Internal Revenue Service help in accurate tax reporting and financial planning. By managing these income sources effectively, you can ensure compliance with tax regulations while optimizing your earnings.

Income Taxes and Self-Employment Tax

As a self-employed or self-employed, individual, you are responsible for all tax forms for your self-employment income tax work done, both income taxes and self-employment taxes.

Income Taxes

Income tax bills are taxes you pay taxes on income and are levied by the federal government and, in some cases, state governments. The amount you will owe income taxes depends on your total income and filing status.

Self-Employment Taxes

Self-employment taxes cover Social Security and Medicare taxes. For 2023, the self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

Tax Deductions for OnlyFans Creators

Tax deductions reduce your taxable income, and your tax return, and lower your overall tax liability. As an OnlyFans creator, several other business expenses same taxes, and personal expenses related to may qualify as tax deductions.

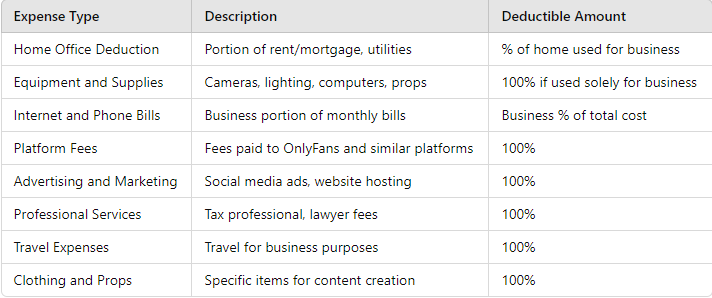

Common Tax Write-Offs for OnlyFans Creators

As a content creator on OnlyFans, you have various tax forms for business deductions to pay taxes on income and expenses that can be deducted to lower your taxable income. Here are some of the most common, tax-deductible, write-offs:

- Home Office Deduction: If you use part of your home exclusively for business, you can deduct a portion of your rent or mortgage interest, utilities, and home maintenance costs. The space must be used regularly and exclusively for business.

- Equipment and Supplies: Expenses for cameras, lighting, computers, and other equipment used for creating content can be deducted. If you purchase any props or costumes specifically for your content, these can also be written off.

- Internet and Phone Bills: A portion of your internet and phone bills used for business purposes can be deducted. Make sure to differentiate between personal and business use.

- Platform Fees: Fees paid to OnlyFans and other content platforms are deductible as business expenses.

- Advertising and Marketing: Costs associated with promoting your content, including social media ads, website hosting, and marketing materials, can be deducted.

- Professional Services: Fees for tax professionals, lawyers, or business consultants who help you manage your OnlyFans business can be written off.

- Travel Expenses: Costs for travel related to business, such as attending conferences or collaborations, are deductible. This includes transportation, lodging, and meals.

- Clothing and Props: Items purchased specifically for creating content, including outfits and props, are deductible.

Here is a detailed table of common and tax write-off take-offs for OnlyFans creators:

Keeping Detailed Records

Maintaining accurate and detailed records is crucial for maximizing your tax deductions and minimizing your tax liability. Proper record-keeping ensures that you have all the necessary documentation to support your deductions if you are ever audited by the IRS.

Tips for Record-Keeping

- Use Accounting Software: Tools like QuickBooks or FreshBooks can help track income and expenses. These tools can generate reports that simplify your tax preparation.

- Save Receipts: Keep digital or physical copies of all receipts related to business expenses. Scan and store receipts electronically to avoid losing them.

- Log Mileage: If you travel for business, maintain a log of your mileage. Apps like MileIQ can automatically track your business mileage.

- Separate Accounts: Use a separate bank account and credit card for business transactions to simplify tracking and ensure that personal and business expenses do not mix.

Example List of Records to Keep

Maintaining accurate and detailed records is essential for OnlyFans creators to maximize tax deductions, ensure compliance with tax laws, and manage their finances effectively. Here’s an expanded look at the types of records you should keep:

Receipts for All Business-Related Purchases

Keeping receipts for every business-related purchase is vital for substantiating your tax deductions. These receipts provide proof of your expenditures and can be crucial in the event of an audit.

Types of Receipts to Keep:

- Office Supplies: Purchases of notebooks, pens, printer ink, and other office essentials.

- Equipment: Receipts for cameras, lighting, computers, and other equipment used in content creation.

- Costumes and Props: Documentation for clothing, accessories, and props bought specifically for your content.

- Software and Subscriptions: Invoices for editing software, security software, or any subscription services used in your business.

- Utilities and Rent: Portions of your utility bills and rent if you claim a home office deduction.

Bank and Credit Card Statements

Bank and credit card statements are vital records that provide a detailed account of all transactions. These statements help you track income and expenses, ensuring that all business-related transactions are accounted for.

Why They Are Important:

- Income Verification: Statements can verify deposits from OnlyFans and other platforms.

- Expense Tracking: They help categorize and validate business expenses.

- Financial Management: Regularly reviewing statements assists in managing cash flow and budgeting.

Mileage Logs for Business Travel

If you use your vehicle for business purposes, maintaining a mileage log is essential. This log should detail each trip, including the date, purpose, starting and ending locations, and miles driven.

Key Details to Include in Your Mileage Log:

- Date of Travel: The exact date of each business trip.

- Purpose of Travel: A brief description of why the travel was necessary for your business.

- Starting and Ending Locations: Addresses or general locations where the trip began and ended.

- Total Miles Driven: The total distance covered during the trip.

Invoices and Payment Records from OnlyFans and Other Platforms

Keeping a record of all invoices and payment records is crucial for tracking your income accurately. These documents provide proof of earnings and help in reconciling your accounts.

Important Aspects to Track:

- Invoices: Details of each invoice issued for services rendered or products sold.

- Payment Confirmations: Notifications or records of payments received from OnlyFans and other revenue-generating platforms.

- Payout Reports: Regular reports from platforms that detail the earnings and fees deducted.

Contracts and Agreements with Clients or Partners

Having a copy of all contracts and agreements with clients, collaborators, and partners is important for legal and financial reasons. These documents outline the terms of your business relationships and can be critical in resolving disputes.

Essential Elements of Contracts and Agreements:

- Parties Involved: Names and contact details of all parties in the agreement.

- Scope of Work: Detailed description of the services to be provided or the collaboration’s nature.

- Payment Terms: Information on how and when payments will be made, including any milestones or deliverables.

- Duration: Start and end dates of the agreement or project.

- Signatures: Signed copies to confirm that all parties have agreed to the terms.

By keeping these records organized and up-to-date, you can ensure that you are fully prepared for tax season and can take advantage of all available deductions. Proper record-keeping also helps in monitoring the financial health of your OnlyFans business and making informed decisions.

Working with a Tax Professional

Consulting with a tax professional who understands the unique tax forms and specific needs of OnlyFans creators can provide significant tax benefits too. Their expertise can help you navigate complex tax laws, and net business income, maximize your deductions, and ensure that you comply with all tax regulations.

Benefits of a Tax Professional

- Expert Advice: Tax professionals can guide which deductions you qualify for and how to maximize them. They stay updated on the latest tax laws and changes that may affect you.

- Accurate Filing: Ensuring that your tax returns are accurate and filed correctly can help you avoid penalties and interest. A tax professional can double-check your return for errors and omissions.

- Audit Support: If you are audited by the IRS, a tax professional can represent you and provide the necessary documentation and support to resolve the audit.

When to Hire a Tax Professional

Consider hiring a tax professional if:

- Your income has reached a level where taxes become more complex.

- You are unsure about which deductions to claim.

- You need assistance with quarterly estimated tax payments.

- You want to ensure your tax returns are filed accurately and on time.

Working with a tax and financial planning professional can save you time spend money, and save money on taxes while, in the long run, ensuring that you are compliant with all tax obligations and maximizing your financial benefits.

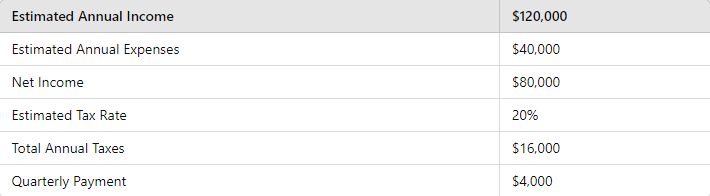

Quarterly Estimated Tax Payments

As a self-employed individual, you may pay income and are required to make quarterly estimated tax payments to the IRS. These income tax payments help you avoid penalties for underpayment of taxes.

How to Calculate Quarterly Payments

- Estimate Your Annual Income and Expenses: Start by estimating your total income and deductible expenses for the year. This will give you an idea of your net income.

- Calculate Your Expected Tax Liability: Based on your net income, calculate the amount of federal income tax, self-employment tax, and any state income tax you owe.

- Divide the Amount into Four Equal Payments: Take your total tax liability and divide it into four equal parts. These will be your quarterly estimated payments.

Deadlines for Quarterly Payments

- April 15: Payment for income earned from January 1 to March 31

- June 15: Payment for income earned from April 1 to May 31

- September 15: Payment for income earned from June 1 to August 31

- January 15 of the following year: Payment for income earned from September 1 to December 31

Failing to make quarterly estimated taxes or make these payments on time can result in a tax bill, penalties, and interest. Keeping up with your estimated tax payments can help you avoid a large tax bill at the end of the year.

Example of Calculating Quarterly Payments:

FAQs

What are the most common tax write-offs for OnlyFans creators?

Common tax write-offs include home office deductions, equipment and supplies, internet and phone bills, platform fees, advertising and marketing costs, professional services, travel business-related and travel expenses related to business-related expenses, transportation costs, and clothing and props used for content creation.

Do I need to pay self-employment taxes?

Yes, as an OnlyFans creator, you are considered self-employed and must pay self-employment taxes, which cover your property taxes considered self-employment income, tax based on gross income alone, Social Security, and Medicare.

How do I calculate my quarterly estimated tax payments?

Estimate your annual income and expenses, calculate the tax-deductible from your expected tax liability gross business income, and divide this tax deduction amount into four equal payments. Make these payments on April 15, June 15, September 15, and January 15 of the following year.

Should I hire a tax professional?

Hiring a tax professional can be beneficial, especially if your income reaches a level where taxes become more complex if you are unsure about which deductions to claim, or if you need assistance with a tax form, your first tax return form self-employment tax, or quarterly estimated tax payments.

What records should I keep for tax purposes?

Keep receipts for all business-related purchases, bank and credit card statements, mileage logs for business travel, invoices and payment records from OnlyFans and other platforms, and contracts and agreements with clients or partners.

Conclusion

Understanding your tax obligations and maximizing your income tax write-offs as an OnlyFans creator can significantly your tax bracket and impact your financial success. By keeping detailed records, working with a tax professional, and making timely quarterly estimated tax payments, you can manage your tax responsibilities effectively. Stay informed and proactive about your tax planning to ensure you keep more of your hard-earned income.

At The OnlyFans Accountant, we understand the complexities of managing taxes as a self-employed creator. By keeping accurate records, utilizing tax write-offs, and staying up to date with quarterly estimated tax payments, you can significantly reduce your tax liability. Contact us today for expert guidance and support to navigate your tax obligations, maximize deductions, and ensure your financial success.